Stocks were under pressure last week as investors appeared to rotate out of mega-cap tech stocks and into areas that may benefit from lower interest rates.

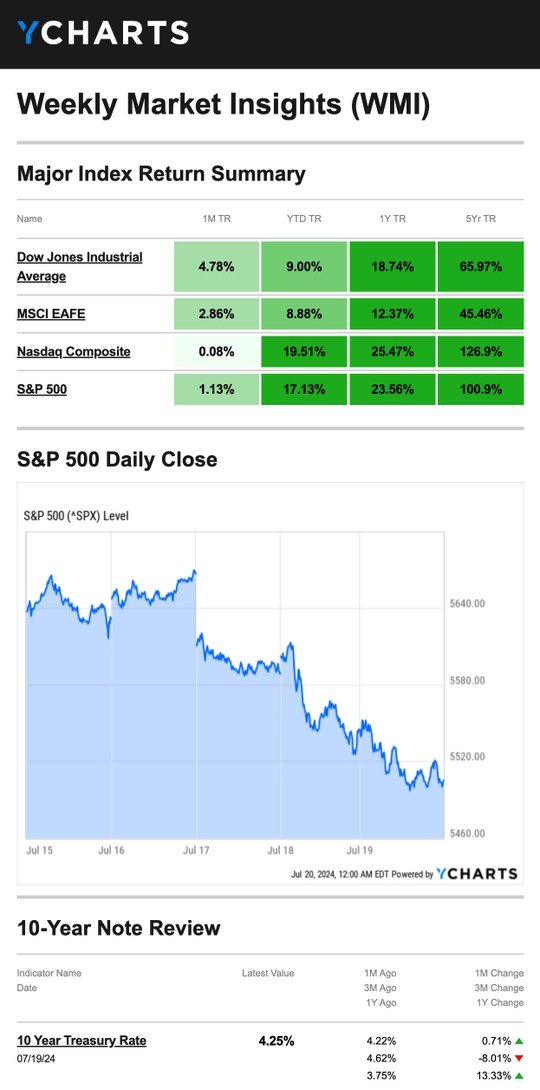

The Standard & Poor’s 500 Index fell 1.97 percent, while Nasdaq Composite Index declined 3.65 percent. The Dow Jones Industrial Average bucked the downward trend, up 0.72 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, slid 1.48 percent for the week through Thursday’s close.1

Dow Leads Again

The week began very differently than it ended.

All three averages rallied over the first couple of days this week, with the Dow leading on both days. Fed Chair Powell indicated the Fed may not wait for inflation to reach its 2 percent target before considering a rate move, buoying the markets.2,3

Then, markets hit a speed bump as investors appeared to take profits and rotated away from mega-cap tech names. The selling broadened beyond tech-related names on Thursday as all but one of the S&P 500’s 11 sectors fell.

Early Friday morning, a global tech outage caused disruptions for businesses, governments, and financial institutions, contributing to the weekly decline. Despite its losses in the second part of the week, the Dow finished in the green.4,5,6

Upbeat Economic Data

Although stocks were under pressure, some investors saw “green shoots” in a few economic reports. Housing starts rose 3 percent in June. Building permits also ticked higher during the month. Retail sales were unchanged in June, which was better than expected. Investors were encouraged that consumers were still spending despite ongoing inflation.7,8

This Week: Key Economic Data

Tuesday: Existing Home Sales.

Wednesday: New Home Sales. Survey of Business Uncertainty.

Thursday: Gross Domestic Product (GDP). Durable Goods. International Trade in Goods. Jobless Claims.

Friday: Personal Income and Outlays. Consumer Sentiment.

Source: Investors Business Daily – Econoday economic calendar; July 19, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Verizon Communications Inc. (VZ)

Tuesday: Alphabet Inc. (GOOG, GOOGL), Tesla, Inc. (TSLA), Visa Inc. (V), The Coca-Cola Company (KO), Texas Instruments Incorporated (TXN), GE Aerospace (GE), Philip Morris International Inc. (PM), United Parcel Service, Inc. (UPS)

Wednesday: International Business Machines Corporation (IBM), AT&T Inc. (T)

Thursday: AbbVie Inc. (ABBV), Union Pacific Corporation (UNP), Honeywell International Inc. (HON)

Source: Zacks, July 19, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Source: YCharts.com, July 20, 2024. Weekly performance is measured from Monday, July 15, to Friday, July 19.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.